BTC’s price has considerably struggled since the US Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs (exchange-traded funds).

Still, the ETFs have attracted many investors, resulting in a record trading volume within the first two days of trading.

Bitcoin ETFs See Record Trading Volume

Available data shows that spot Bitcoin ETFs collectively achieved a substantial trading volume of approximately $8 billion. The volume peaked at approximately $4.6 billion on the inaugural day, followed by a volume exceeding $3 billion on the second trading day.

Grayscale’s GBTC ETF emerged as the most actively traded spot Bitcoin ETF during this period. Impressively, it recorded a total trading volume surpassing $4 billion, solidifying its position at the forefront of the market.

New issuers like BlackRock, Fidelity, Bitwise, and others also saw considerable trading activities during the days. Notably, BlackRock CEO Larry Fink praised the early success, adding that he saw the top cryptocurrency as an asset class rather than a currency.

However, some analysts argued that this early trading activity was a flop because most came from Grayscale outflows. But Bloomberg analyst Jeremy Seyffart countered that such arguments were “clickbait” based on “god candle expectations that were out of touch with reality.”

“We kept talking about how a significant amount of money into these things were going to come from other Bitcoin and crypto related exposures. And we kept talking about the longer term impact of what these may open up as a bridge. Anything talking about this being flop or terrible is either click bait or just had “god candle” expectations that were out of touch with reality,” Seyffart added.

BTC Price Falls Following Sell Pressure

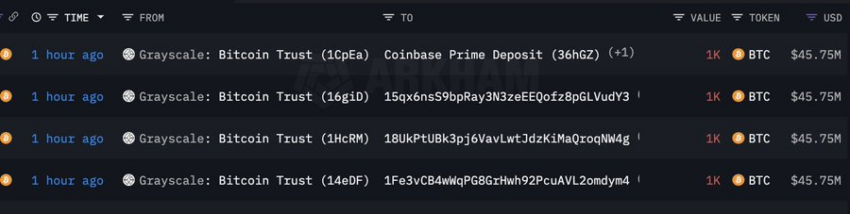

Amidst the heightened trading activity, Grayscale transferred 4,000 BTC valued at $183 million to Coinbase. This transaction, conducted in four batches of 1,000 BTC each, transpired on Coinbase Prime, a significant participant in the recently initiated Bitcoin ETFs.

It is worth highlighting that Coinbase serves as a broker and custodian for Grayscale. So, these BTC transfers may constitute a deposit originating from the sale of Grayscale’s ETF.

Read more: Did Bitcoin Hit a Market Top? Smart Whale Sold 2,742 BTC

Additionally, on-chain analyst JA Maartunn noted the potential for increased sell orders in the Bitcoin market. He pointed out that two sell orders, encompassing 1,900 BTC, were positioned to trigger at specific price points. The first is 894 BTC at $44,000 and an additional 1,071 BTC when the asset reaches $45,100.

“There is currently a prolonged period of strong selling pressure, which may have peaked. It is possible that the price may begin to revert to the mean at this time,” crypto analyst Maartunn stated.

These transactions significantly impacted BTC’s price. Bitcoin dropped by more than 7% to under $42,000 before rebounding to $42,781 as of press time.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment