Zcash (ZEC) price continued from where it stopped last week, reaching a new yearly high on Monday before its recent pullback. On the mentioned date, the privacy coin hit $45.45.

This price marks not only ZEC’s highest level this year but also its peak since March 2023.

Zcash Plans Proof-of-Stake Move, Wants Circulating Supply Reduced

Zcash (ZEC) has surged nearly 45% in the past 30 days, making it one of the top-performing altcoins in early August. On July 15, ZEC traded at $28.54, but it has since experienced notable growth.

According to BeInCrypto, this rise isn’t solely driven by buying pressure or general market interest. A key factor behind the increase is speculation around Zcash’s possible shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS). ZEC has traditionally relied on the PoW algorithm, similar to Bitcoin (BTC).

However, on August 10, Zooko Wilcox, the project’s founder, hinted at a transition to PoS. Wilcox noted that the creation of new ZEC through PoW has contributed to downward price pressure over the years, which the recent uptrend is beginning to reverse.

Wilcox, in a statement via Medium, opined that the move to PoS will ease downward pressure on ZEC price as it aims to reduce new coin creation. Explaining how PoS will positively impact the cryptocurrency’s value, the founder shared that:

“It will allow people to stake their ZEC, thus increasing demand for ZEC. It will also reduce the supply of ZEC by locking up staked ZEC.”

Supporting the founder’s concern about increased supply, data from Messari reveals that Zcash’s new issuance has risen to 157,000 coins as of this writing. On July 1, this figure was below 70,000, highlighting a sharp increase in circulating coins.

Read more: How to Buy Your First Zcash

It’s important to note that the transition to Proof-of-Stake, if implemented, will only be partial. Once completed, a portion of ZEC’s supply will be staked, reducing new issuance and potentially creating upward pressure on the price.

ZEC Price Prediction: Another Peak Is Close

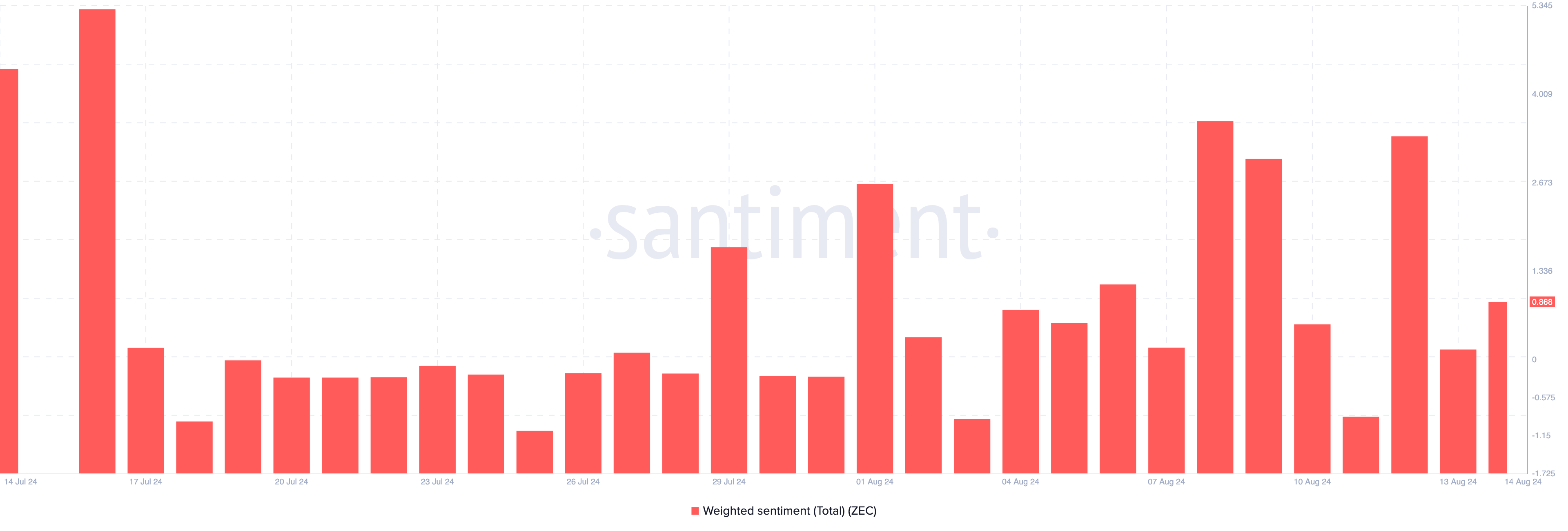

From an on-chain perspective, Santiment data show that Weighted Sentiment around ZEC has increased. This metric uses social volume to gauge the perception surrounding a project in the market.

If the Weighted Sentiment reading is positive, then most comments are bullish. However, a negative rating implies that a large part of discussions tilt toward the bearish end. For ZEC, the reading had initially dropped on August 13.

However, at press time, it has improved, suggesting that market participants are confident in Zcash’s short-term price performance. If this remains the case, demand for ZEC may increase, as may the value.

On the technical side, the daily chart reveals that ZEC’s price has been forming Lower Highs (LH) since July. This formation indicates strong support almost every time the price has increased.

In addition, the Exponential Moving Average (EMA) provides further insight into ZEC’s trend. The EMA is a technical indicator used to gauge trend direction. When the shorter EMA is positioned above the longer EMA, it indicates a bullish trend, while the reverse signals a bearish trend.

On July 14, the 20-day EMA (blue) crossed above the 50-day EMA (yellow), forming a golden cross. This pattern typically confirms a bullish outlook, reinforcing ZEC’s upward momentum.

Read more: Zcash (ZEC) Price Prediction 2024/2025/2030

The shorter EMA continues to outpace the longer one, indicating potential for further gains. If this trend holds, ZEC’s price could reach $46 in the short term.

However, a bearish crossover could disrupt this outlook. If profit-taking intensifies, ZEC’s value might decline to around $36.74.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment