Ethereum (ETH) whales are at it again, but this time, they are not selling the cryptocurrency as they did for some parts of the year. Instead, on-chain data shows notable ETH accumulation, with retail investor interest also building up.

What does this mean for ETH? BeInCrypto reveals all the details, analyzing the developments and their potential impact on Ethereum’s price.

Ethereum Retail Investors, Big Wigs Are Buying

On November 29, Ethereum’s large holders’ netflow stood at 28,680 ETH, but today, it has surged to 80,130 ETH. Netflow measures the difference between coins accumulated and those sold by whales.

A positive netflow indicates that whales are purchasing more tokens than they are selling, a typically bullish signal. Conversely, a negative netflow suggests increased selling, often bearish for price action.

The latest data reveals that Ethereum whales have accumulated approximately 51,450 ETH — worth around $188 million — in just two days. If this buying trend continues at similar volumes, ETH’s price could push past $3,700.

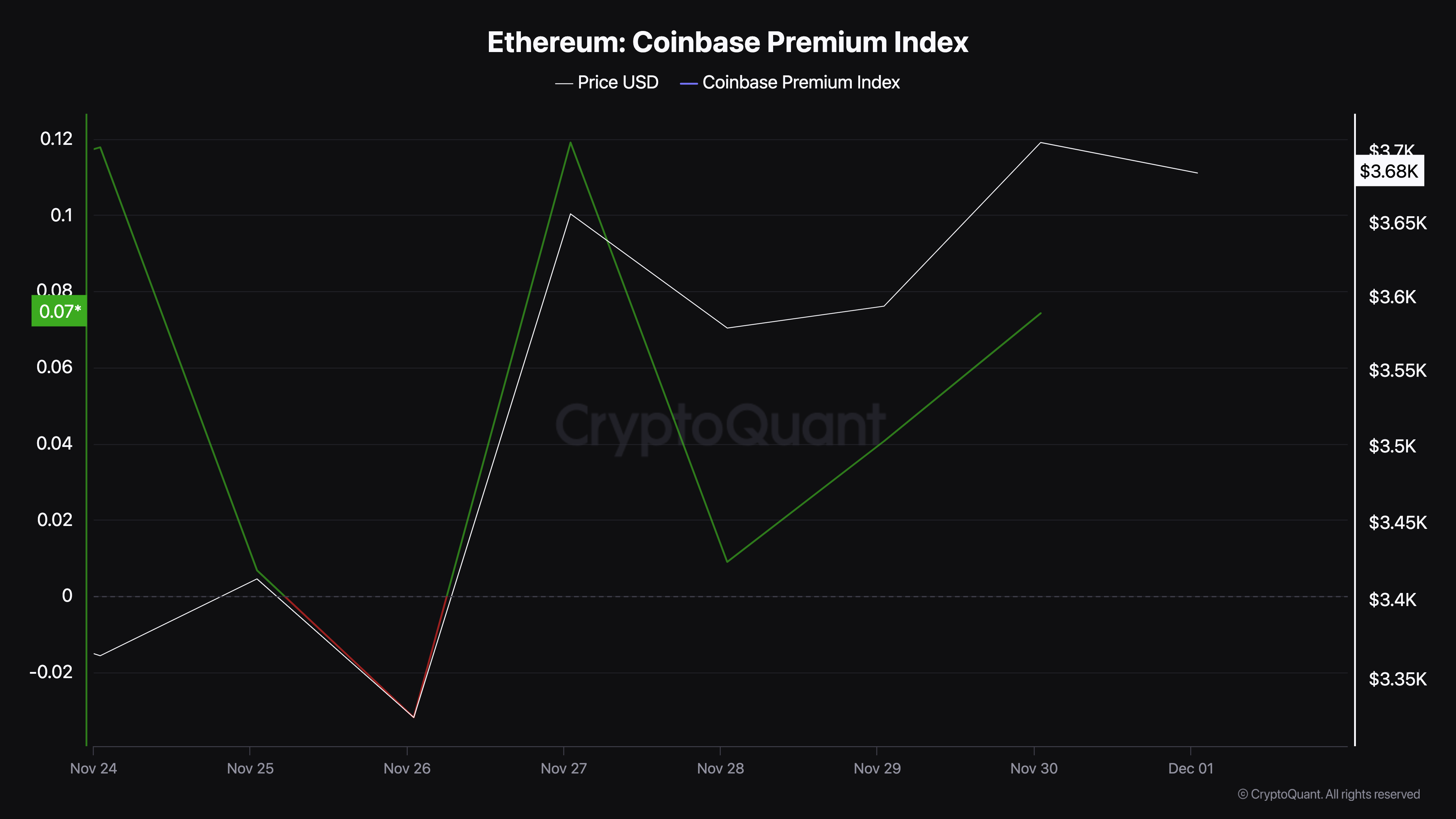

Besides whales, CryptoQuant data shows that the Coinbase Premium Index has increased. The index measures the difference between the ETH/USD Coinbase price and the one on Binance.

A negative reading typically signifies selling pressure, particularly from U.S. investors. Conversely, a positive index suggests increased buying pressure — a trend currently observed for ETH.

If US investors continue accumulating ETH, this growing demand could drive the cryptocurrency’s price higher, supporting its potential climb, as previously noted.

ETH Price Prediction: Strong Support, Higher Value

Based on the daily chart, the Parabolic Stop And Reverse (SAR) indicator is below ETH’s price. The Parabolic SAR is a technical indicator used to determine the price direction of an asset.

When the dotted line of the indicator is above the price, it indicates resistance. As such, the asset in question finds it challenging to climb higher. However, in Ethereum’s case, the indicator is below the price, suggesting that the cryptocurrency has strong support to keep up with its uptrend.

Furthermore, BeInCrypto observed the formation of a bull flag, which suggests that buyers have blindsided sellers. Considering this position, ETH’s price could climb to $4,000.

However, it is important to mention that Ethereum whales might also have a role to play in this prediction. Should these key stakeholders continue to rise, then ETH might hit the mentioned target.

On the other hand, if whales stop buying, this forecast might be invalidated. In that scenario, Ethereum could decline to $3,425.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment