BUSD’s market share has been dwindling for months now and the decline shows no sign of slowing down.

Even Binance appears to have abandoned support for its dollar-pegged stablecoin, which was once a dominant force on the cryptocurrency exchange.

BUSD Loses Market Share

In the past month the market capitalization of BUSD has fallen by 16.14%, DeFiLlama data shows.

Alongside other well-known stablecoins, BUSD is losing out to USDT dominance. According to Blockworks, on Sunday Aug. 6, Tether’s flagship stablecoin accounted for a 67.17% share of the total market.

When Binance first launched BUSD in 2019, it put its full weight behind the stablecoin. With the backing of the world’s largest crypto exchange, it took just 261 days for BUSD to amass a market capitalization of $1 billion USD. And it achieved this milestone faster than any other stablecoin.

Within a year, the exchange had listed 97 BUSD trading pairs. At its peak, that figure climbed to over 300.

But in the past year, Binance has been forced to put the brakes on BUSD.

In February, the stablecoin issuer Paxos ended its partnership with Binance and stopped minting BUSD at the request of the New York Department of Financial Services (NYDFS).

In a June tweet, Binance CEO Changpeng Zhao (CZ) claimed that the NYDFS had essentially capped the potential supply of BUSD at $23 billion, a fact he associated with the growth of rival USDT.

Has Binance Given up on BUSD?

Amid declining market share and Tether’s growing dominance, Binance has somewhat changed course on BUSD.

After the platform removed eight BUSD spot trading pairs on Wednesday Aug. 2, there are now only 289 pairs available to BUSD users. By contrast, Binance lists 352 USDT trading pairs.

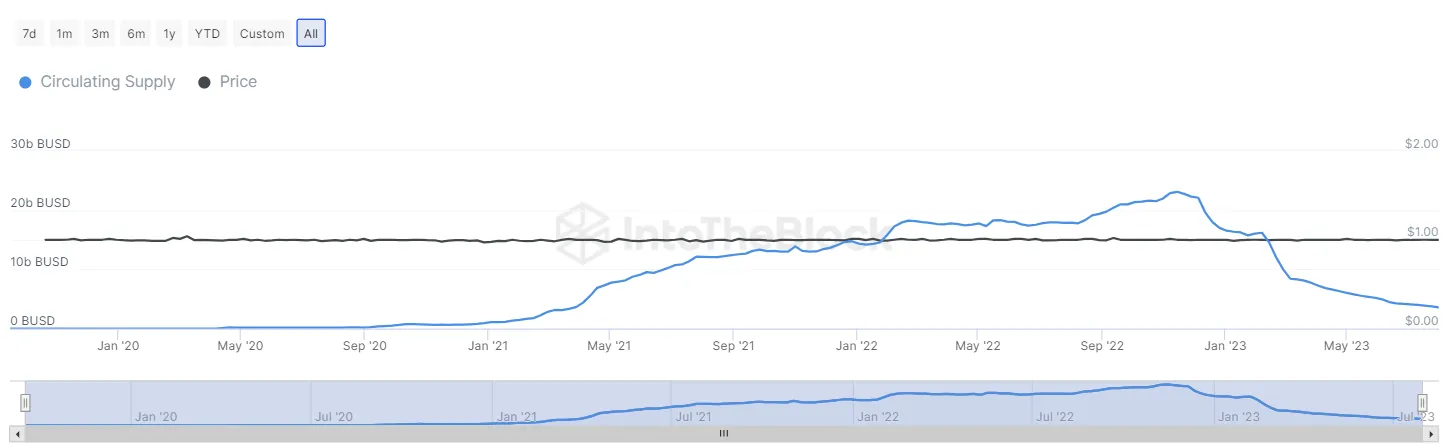

Against the backdrop of shrinking support from its parent platform, data from IntoTheBlock shows that the circulating supply of BUSD has declined by nearly 81% in the past year alone.

Moreover, recent Binance Launchpool events have favored alternative stablecoins as staked assets. While BUSD-staking was once a staple of the exchange’s token-farming platform, it has been absent from recent pools.

In its place, the latest Launchpool events have embraced the new stablecoin FDUSD. While the Launchpools run throughout August, participants can earn CYBER and SEI by staking either BNB, TUSD, or FDUSD.

Tether–Binance Rivalry Heats up

While Binance’s latest Launchpools have abandoned BUSD-staking, the platform hasn’t just rolled over and accepted defeat at the hands of Tether, even though it has enabled USDT staking in previous rounds.

Moreover, during an AMA in May, CZ criticized the world’s largest stablecoin for a lack of transparency, calling USDT a “black box”.

In Tether’s corner, on the other hand, CTO Paolo Ardoino recently threw digs at FDUSD after it gained significant traction at the beginning of August.

In May, First Digital’s debut of FDUSD received a significant boost from Binance, which celebrated its listing by offering zero trading fees for selected FDUSD trading pairs.

USDT Reserves in the Spotlight

CZ isn’t the first person to object to Tether’s collateralization strategy, which critics argue is opaque.

Against such allegations, Tether has moved to improve transparency into its USDT reserves, which consist mostly of US Treasury Bills and other liquid, dollar-based assets.

For detractors, however, the 85% of USDT reserves made up of cash and cash equivalents aren’t the issue. It’s the other 15% that they object to.

For Tether, a key victory against such complaints came this week, when a judge dismissed a class action lawsuit that claimed it misled investors.

The complaint underscored one of the most common criticisms of USDT. Namely, that Tether’s claim its stablecoin is redeemable one-for-one with fiat dollars is misleading.

However, now that the case has been thrown out, Tether’s strategy of putting 15% of USDT reserves into alternative investments has been legitimized in court.

Tether’s Bitcoin Balance Increases by $176M

Alongside corporate bonds, precious metals, and secured loans, Tether has also invested in Bitcoin. And in May, the company stated its intention to allocate 15% of its profits into the cryptocurrency.

Since then, Tether’s Bitcoin holdings have ballooned. According to blockchain analyst Tom Whan, the company now holds 55,000 BTC, worth $1.6 billion USD. This represents an increase of $176 million since the previous quarter.

In fact, a BTC address identified by Whan as belonging to Tether is the 11th most well-funded in existence and contains around 0.3% of all BTC in circulation.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

Be the first to comment