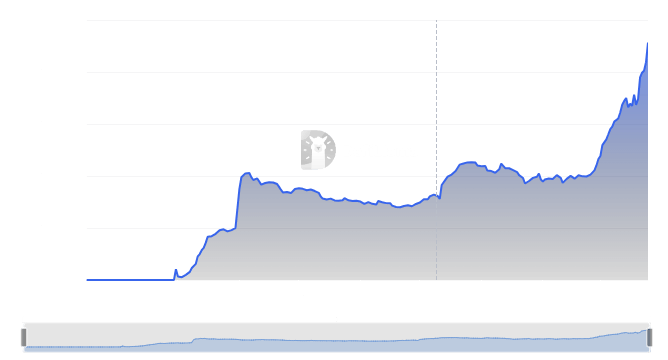

Base TVL is up more than 126% in the past month, up from around $405 million on February 25.

TVL has reached $913 million amid meme coins frenzy and could hit $1 billion this week.

The Total Value Locked (TVL) on Base, an Ethereum layer-2 protocol launched by Coinbase, has reached a new high above $900 million.

Data on DeFiLlama showed the TVL stood at over $913 billion on March 25, up by more than 126% from $405 million on February 25. Bridged TVL was valued at over $1.15 billion.

Base meme coins send TVL soaring

In the past few weeks, the spotlight has been on Solana-based meme coins. The likes of dogwifhat, Bonk Book of Meme, Slerf and Myro have dominated the market with massive gains.

But Base meme coins have seen a decent spike in the past 24 hours, with data showing their market cap has increased more than 400% in 24 hours to nearly $1 billion.

Buying frenzy has hit tokens such as Toshi (TOSHI), Degen (DEGEN) and Mochi (MOCHI), which have all soared more than 30% in the past day.

Nansen highlighted the growth in TVL, noting a surge could see it hit $1 billion this week.

Base TVL is up over 25% from last week ($705m to $892.6m), with the network on the path to hit $1b TVL this week

it looks like @base szn is here pic.twitter.com/x5rRRxnw1s

— Nansen 🧭 (@nansen_ai) March 25, 2024

RWA tokens on the rise

Real world assets (RWAs) have also contributed to Base’s emerging as a force in the market.

With the recent Dencun upgrade in place, low fees sees interaction with dApps on the rise. Users and investors are also taking key dips into the RWA market, eyeing gems.

On-chain data shows a notable impact on Base TVL from RWA projects, including a 28% spike in TVL for Tangible RWA and nearly 6% for Cygnus Finance.

Overall rise in RWA tokens saw the sector’s market cap soar more than 25% to above $7 billion. Top tokens in this market include Ondo Finance, Polymesh, Pendle and TokenFi.

Apart from meme coins and RWA, two other narratives likely to lead the bull cycle are artificial intelligence (AI) and Decentralized Physical Infrastructure Networks DePINs).

Be the first to comment